Understanding your how much your business insurance costs will help you manage them. Like everything else, rates for business insurance can vary depending on where your business is located, the type of coverage you need, and other factors within your control. And one of the most important things to understand is that not all businesses are created equal when it comes to pricing. Businesses with fewer employees, a smaller physical footprint, and activities that don’t involve money (like hobbies or service-based ventures) tend to have cheaper insurance costs than those with more employees, a larger physical footprint, and activities that involve money like operating a business or sole proprietorship. Understanding how much business insurance costs will also help you identify potential savings opportunities as well as alternative ways of obtaining the same level of protection at lower cost.

How Much Does General Liability Coverage Cost?

Commercial liability coverage is designed to help protect businesses from lawsuits filed by people who are injured on the business’s property or while on its premises. This type of coverage is often required by lenders when a business takes out a loan or signs a commercial lease.

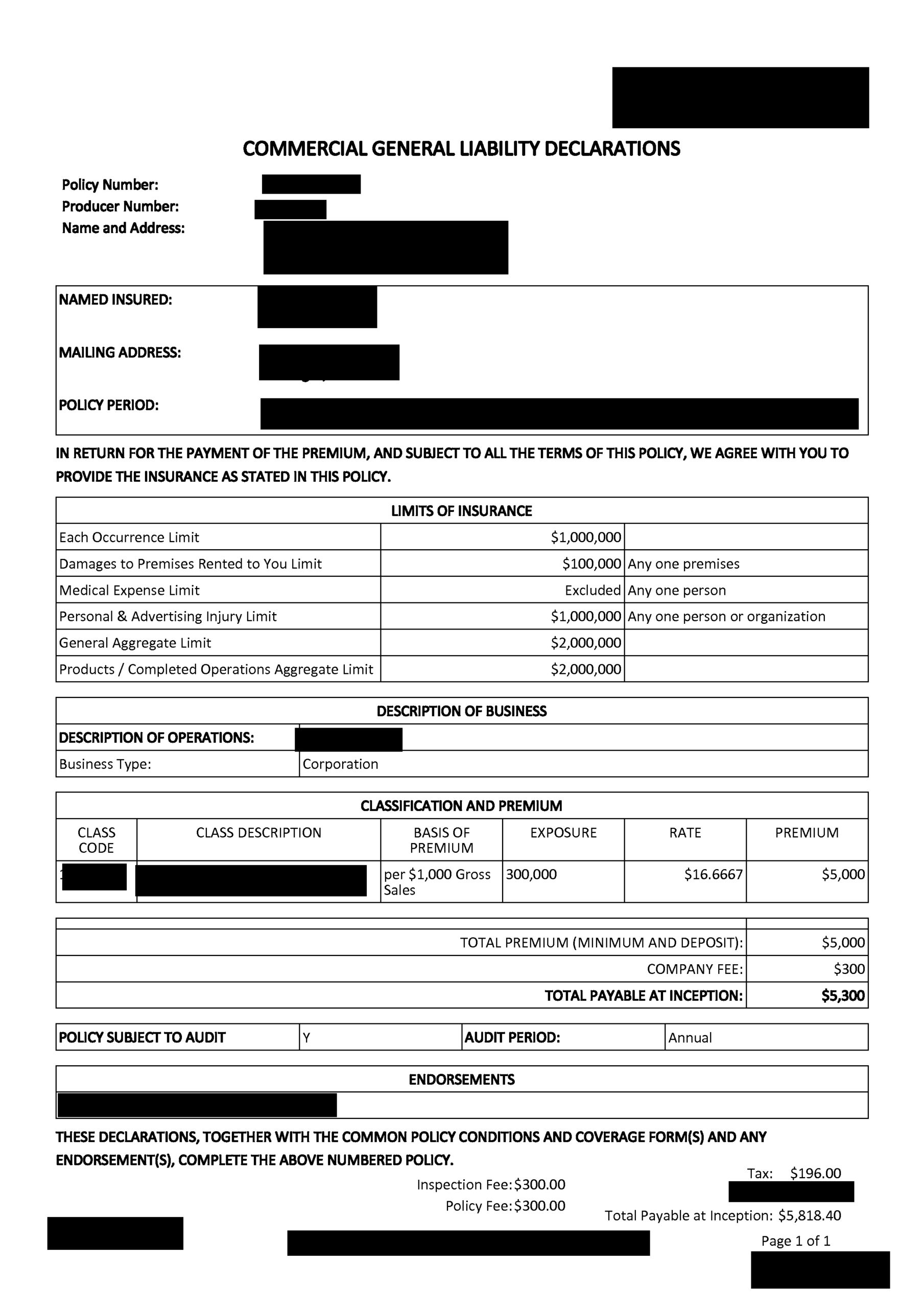

A General Liability insurance policy cost is usually based on revenue. The multiple is usually between $10-$20 dollars per $1000 of gross sales. To figure out how much your general liability insurance will cost you will need a revenue projection. As you can see from the example in the above redacted business insurance declaration page this 1,000,000 general aggregate insurance policy is based on a revenue number of $300,000. At the rate of $16.66667 per $1000 in gross sales, this policy costs $5000 per year.

How Much Does Commercial Property Insurance Cost?

The cost of a policy will vary depending on the size of your business, where you operate, and the coverage level you choose. For example, a small biz with a modest amount of assets and income may be able to get a commercial property insurance policy for as little as $1,000 a year. But more businesses have coverage that costs $10,000 or more. There are a number of things you can do to help narrow the gap between what you pay and what you can get. First, investigate all your options and make a list of what coverage you need and at what cost. At this point, you want to critically evaluate all your options to see what will fit your budget best. Next, compare the cost and coverage level between different types of insurance – auto, property, workers compensation, etc. You may find that the best fit is something other than the commercial policy you initially thought you needed.

How Much Does Business Owner Insurance Cost?

Household and business insurance policies are often lumped together, but the two sets of policies have different coverage requirements and limitations. Some experts recommend that only businesses with employees purchase business owner insurance, but that’s simply not true. Certain types of business owner policies are designed specifically to cover sole proprietorships and other unincorporated businesses. If you own a small business with no employees, then you should be able to get coverage for significantly less than if you had a large company with many employees.

How Much Does Business Auto Insurance Cost?

Business auto insurance is often lumped with business owner auto insurance, but the two sets of policies have different requirements and coverage limitations. Business auto insurance is designed to cover vehicles used for business. These policies typically include a provision that allows business owners to operate on a “permissive” basis – that is, to use their vehicle for business purposes without paying for the insurance.

How Much Does Employment Practices Insurance Cost?

Employment practices coverage is a unique type of business insurance that protects companies against lawsuits filed by former employees. This type of insurance is sometimes called “wrongful termination” insurance, “employment practices” coverage, or “ERISA” insurance. This type of coverage differs from traditional commercial insurance policies in a number of ways. First, it’s meant to protect against lawsuits filed by former employees. A lawsuit filed by a current employee is covered by workers compensation insurance.

How Much Does Equipment Insurance Cost?

Equipment insurance covers the cost of repairing or replacing an item of operational or financial equipment if it is lost, stolen, destroyed, or damaged in a covered accident. This type of coverage is often required by lenders when a business takes out a loan.

How Much Does Flood Coverage Cost?

Flood coverage protects your business in the event of a flood. This type of coverage is often mandatory in some areas, but it may be optional in other parts of the country. Think about your risks, and then decide whether it makes sense to buy flood coverage. Some possible risks that you may face include a major flood, a storm that causes flooding, or a fire that causes flooding.

Summing up – Which Is Most Important To You?

These are just a few of the many factors that can affect the cost of business insurance. It’s important to understand your own business and its unique risks so that you can make informed decisions about how much business insurance you need and what it will cost. As you can see, there are many different factors that can affect the cost of business insurance making it difficult to put a number on the policy that is right for you. Understanding how each one works will help you identify good savings opportunities as well as alternative ways of obtaining the same level of protection at lower cost.