The term “retained earnings” usually brings to mind images of pension fund managers sipping from crystal glasses and listening to Baroque music. It doesn’t exactly sound like your average banker, does it? But while that image might be a little outdated, what is commonly referred to as retained earnings actually make up a big part of the balance sheet. And the more money you have at your disposal, the more likely you are to invest that money in ways that will yield the highest return.

That’s because retaining earnings means you own the cash that comes from operations and can reinvest them. You don’t have to spend it or give it out as loans — you can keep it for yourself! In this article, we take you through some of the most common reasons you might have retained earnings and how you can find them on your balance sheet when looking to improve your returns.

What are Retained Earnings?

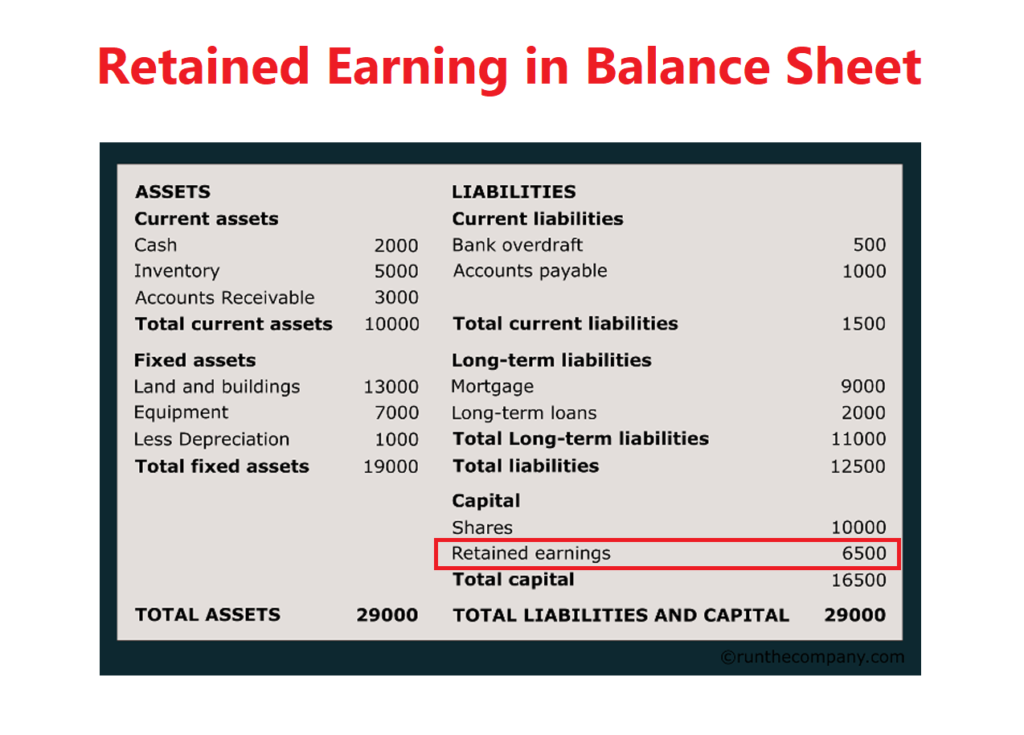

Retained earnings are funds on hand that are not needed for immediate use. These funds are often represented by a reserve or surplus balance on the financial statement. Retained earnings are money that is not needed for immediate use and can be used for investments.

How to find retained earnings on your balance sheet

The first and foremost way to find retained earnings on your balance sheet is to look inside your bank. If your bank has a separate entity called a “retained earnings department”, then you are in luck! This is where you can find the data and details of all your holdings. The accounting information for assets, liabilities, and earnings is recorded in its financial statements. The major items recorded in these statements are cash and cash equivalents, accounts receivable, and assets held for sale. You can also use software like QuickBooks to track your assets, liabilities, and cash flow. Keep in mind that these accounting records are not a perfect reflection of how much money you have in the bank.

The importance of retained earnings

Retained earnings are a key indicator of a companies health and their potential to profit from operations. A healthy company has a healthy balance sheet. If there isn’t much cash lying around, then that means more revenue is coming in, and, more importantly, those funds are being invested. If you are an investor and you are looking for stocks with the best chance of success, then look towards companies with a healthy balance sheet. These are companies with plenty of cash on hand that can easily sustain their daily operations by investing that cash in ways that produce the most value. A healthy company has a healthy balance sheet, and healthy companies make healthy profits. A healthy company has plenty of cash on hand to invest in ways that yield the highest return.

How banks use retained earnings

When a owners buy a new house, they typically have a surplus of money sitting in their savings account. After they buy their house, they will use the money from their savings account to pay for the mortgage. But what happens if the house goes on the market and the new owners have to come up with the cash to buy it? The surplus in the savings account will become a negative amount. In other words, the bank will have to pay back the owner of the house.

In some cases, the bank will sell the mortgage note to cover the negative equity in the house. This is a cash-out method, and it is also known as a cash-rich purchase. In other words, the bank gets cash and the owner of the house has equity. The bank’s owners can then use that equity to buy other stuff, or invest it in the stock market.

Summary

Retained earnings are funds a company has on hand that are not needed for immediate use. These funds are often represented by a surplus balance on the companies financial statements. A healthy company has a healthy balance sheet. A healthy company has plenty of cash on hand to invest in ways that yield the highest return. A company with healthy retained earnings is likely investing those funds in ways that will yield the highest return for shareholders. That’s it. That’s all you need to know to find retained earnings on your balance sheet when looking to improve your returns. Now go execute!