You’ve just been promoted. You have a new boss and she has asked you to integrate the accounting team at your company. You are excited, but you aren’t sure how to proceed. Suddenly, one of your coworkers brings up the topic of reading a trial balance. A trial balance is a section in an accounting report that details assets, liabilities, and owner’s equity accounts on one sheet. It is used as a tool to analyze the financial position of a business enterprise prior to making any significant transactions or investments. Here are some tips on how to read a trial balance:

What is a Trial Balance?

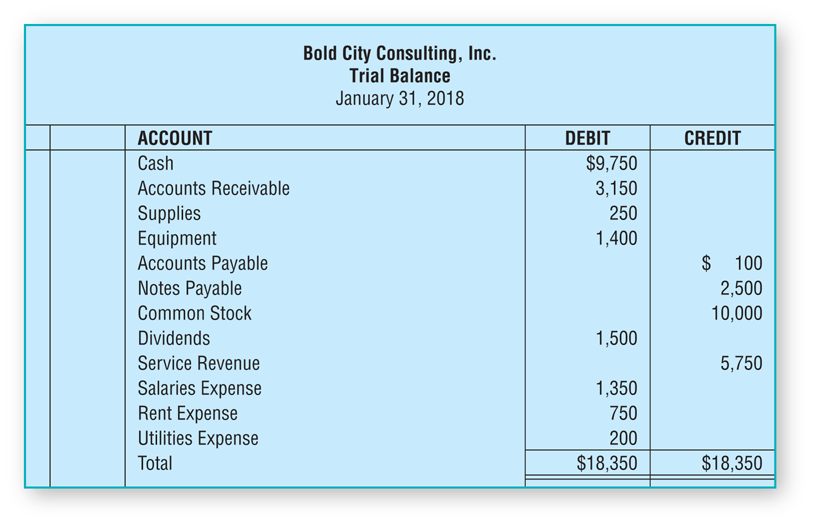

A trial balance is a single piece of paper that lists an organization’s assets, liabilities, and owners’ equity accounts on one page. The trial balance provides a snapshot of a business at a specific point in time. It is typically used to analyze an organization’s financial position prior to making any significant transactions or investments. In other words, it is a snapshot of your business as of a specific time. A trial balance is a single piece of paper that lists an organization’s assets, liabilities, and owners’ equity accounts on one page. The trial balance provides a snapshot of a business at a specific point in time. It is typically used to analyze an organization’s financial position prior to making any significant transactions or investments. In other words, it is a snapshot of your business as of a specific time.

How to Read a Trial Balance?

A trial balance is a critical part of any financial reporting. It helps you analyze your assets, liabilities, and owners’ equity accounts as of a specific date. You can use this information to get a general idea of how your business is doing. However, you cannot use this information to make any significant transactional decisions. Trial balances are often written out in accounting terms. This is because they also list a variety of financial information such as accounts payable, income taxes payable, and cash. It is a simple list of accounts, with nothing fancy. The purpose of the trial balance is to provide a snapshot of your financial position at a specific point in time. In other words, it is a list of your assets, liabilities, and owners’ equity accounts as of a specific date. You can use this information to get a general idea of how your business is doing. However, you cannot use this information to make any significant transactional decisions. Trial balances are often written out in accounting terms. This is because they also list a variety of financial information such as accounts payable, income taxes payable, and cash. It is a simple list of accounts, with nothing fancy. The purpose of the trial balance is to provide a snapshot of your financial position at a specific point in time.

You Are in Control

The most important thing to remember is that reading a trial balance is a process that you control. There is no one else in the world who can do this work for you. The only person who can make decisions about your business is you. If you are confused by anything that you read on the trial balance, then simply ask yourself, “does this entry make sense to me?” If the answer is “no”, then you should reconsider what you are reading. Trial balances simply reflect the financial position of your business as of a specific date. They do not tell you how to make any significant decisions. The trial balance is simply a tool that allows you to analyze the financial position of your business as of a specific point in time.

What Does a Trial Balance Show?

A trial balance is a list of assets, liabilities, and owners’ equity accounts on one page. The trial balance provides a snapshot of a business at a specific point in time. – Assets are items of value that a business owns, such as cash, accounts receivable, inventory, and property. – Liabilities are claims that an organization owes, such as accounts payable, accrued expenses, and loans payable. – Owners’ equity accounts are the difference between assets and liabilities. It represents the net worth of the business.

Bottom Line

A trial balance is a single piece of paper that lists an organization’s assets, liabilities, and owners’ equity accounts on one page. The trial balance provides a snapshot of a business at a specific point in time. It is typically used to analyze an organization’s financial position prior to making any significant transactions or investments. In other words, it is a snapshot of your business as of a specific time. A trial balance is a single piece of paper that lists an organization’s assets, liabilities, and owners’ equity accounts on one page. The trial balance provides a snapshot of a business at a specific point in time. It is typically used to analyze an organization’s financial position prior to making any significant transactions or investments. In other words, it is a snapshot of your business as of a specific time.

Glossary

Trial balance

A list of assets, liabilities, and owners’ equity accounts on one page. The trial balance provides a snapshot of a business at a specific point in time.

Owners’ equity accounts

The difference between assets and liabilities. It represents the net worth of the business.

Accounts payable

A form of liability in which a business owes money to its suppliers.

Accrued expenses

A form of liability in which a business owes money to itself, such as employee wages and benefits.

Cash

The money in a business that is not invested in assets.

Income taxes payable

A liability that occurs when a business pays income taxes.

Resources

There are many books that are written on accounting. You can find a great resource by doing a simple search on Amazon. When choosing a book, make sure that it is one written for non-accountants. Trial balances are very straightforward and most people can read and understand them. However, reading a trial balance is not as easy as it sounds. For example, trial balances are often written in accounting terms. This means that the numbers on the paper are written as percentages, rather than amounts. The numbers on a trial balance will probably look a little bit like the following. You will see assets of $100,000, liabilities of $50,000, and owners’ equity of $50,000.

Conclusion

A trial balance is a single piece of paper that lists an organization’s assets, liabilities, and owners’ equity accounts on one page. The trial balance provides a snapshot of a business at a specific point in time. Reading a trial balance is a simple process that anyone can do. It is important to remember, however, that reading a trial balance is a process that you control. There is no one else in the world who can do this work for you. Once you’ve read the trial balance, you can use it as a reference to better understand your business.